High net worth individuals (HNWIs) have been putting more money into Chinese stocks in recent years not only because China rapidly grew as the world’s second-largest economy but also because Chinese stocks had become more accessible after an increasing number of Chinese companies went public in the U.S. exchanges.

However, in recent weeks, the HNWIs were plagued by the delisting crisis of Chinese stocks in the U.S. markets. The risk of more than 200 Chinese-funded companies valued at more than one trillion U.S. dollars facing forced delisting from the New York Stock Exchange and Nasdaq caused the Chinese stock market to shake dramatically.

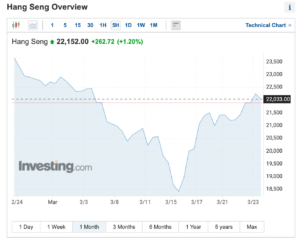

The Hang Seng Index and Nasdaq Index are the hardest-hit areas in this incident, which witnessed a rapid V-shape decline and recovery within the first three weeks of March 2022, finally triggering the Chinese and American regulators to respond officially. Still, the market concerns were not relieved.

The Hang Seng Index and NASDAQ index went through a V-shaped slump and recovery in March. Source: Investing.com

What is happening to the Chinese stocks?

In 2020, the U.S. Congress passed the 《Holding Foreign Companies Accountable Act》 requiring U.S.-listed companies to declare they are not owned or controlled by a foreign government. Companies have to submit specific audit reports to the U.S. government to fulfil the act’s declaration requirements. Or, if they violate the rules for three consecutive years, they will be delisted from the U.S. market.

What triggered the recent sharp fall of Chinese stocks was that the United States Securities and Exchange Commission announced a provisional waitlist of five Chinese firms that may be removed from the U.S. stock market. A brutal stock market crash was then exposed since more than 200 Chinese companies were listed on the U.S. exchanges. It is almost impossible for them to meet the U.S. compliance requirement under the current Chinese law, which means all these Chinese companies are at risk of being delisted.

The Nasdaq Golden Dragon China Index of large Chinese stocks has plunged more than 20% in just a few days. The largest U.S.-listed Chinese stock, Alibaba Group, lost 26% of its value between 8 March and 15 March 2022.

The sliding trend was reversed on 16 March 2022 when the Chinese government signalled support to Chinese companies to go IPOs ab support and confirmed the Chinese and U.S regulator were communicating and working on a cooperation plan on U.S.-listed Chinese stocks. The Hang Seng Index and Nasdaq Golden China Index immediately soared by 9% and 33% on the same day the announcement was made.

Is returning to Hong Kong a Solution?

Being delisted from the U.S. stock market is undoubtedly a disastrous crash to the Chinese stocks. Optimistic analysts believe those companies can switch their listing location to Hong Kong as a risk avoidance measure and maintain their ability to raise international funds and expose them to the global market.

Large Chinese firms listing the U.S. market, such as NIO or Weilai automobile, have recently moved to the Hong Kong stock market to diversify their risk. However, after “returning to Hong Kong” for listing, those companies’ stock price performances were usually unsatisfactory, causing the valuation to be under pressure.

One major reason is that institutional investors are wary of whether the United States will introduce further restrictions to certain types of Chinese stocks. Whether the current low valuation can offset political and regulatory risks is full of uncertainty. As a result, fund managers tend to take a more defensive approach in deploying assets for HNWIs. Chinese companies have to cope with this problem if they regard Hong Kong as their alternative listing location.

In addition, there are plenty of obstacles preventing some Chinese stocks from getting listed in Hong Kong. Didi Chuxing, for instance, announced late last year that it plans to delist from the United States and seek a listing in Hong Kong. However, according to Bloomberg, it has halted the plan because it failed to meet the rectification requirements of Chinese regulators on users’ sensitive data.

Is the Chinese Stocks Issue Resolved?

No, the incident is obviously far from reaching an end. Although there is a constructive dialogue between China and the U.S., negotiation continues and has not ended. The two countries have their plans and multiple issues to bargain on the negotiating stage. Investors have to stay calm and observe whether New York or Hong Kong will be the final destination of the Chinese stocks before making a weighty investment decision.